Everything you need to know about BHIM App – The Complete Review!

|

| Image Source: SarkariYojna.co.in |

The day when demonetization started, India started growing with full speed towards Digital Economy. After demonetization, the Indian government came up with the UPI Payment System. The UPI stands for Unified Payment Interface. In case you don’t know anything about UPI – You can read my post “Everything you need to know about UPI (Unified Payment Interface)”

The reason I have provided details about UPI above, is that – The BHIM App runs with the same interface system i.e., UPI (Unified Payment Interface) System. Now let’s see everything we need to know about the BHIM App….

First of all, let me tell you that the name BHIM is not taken from the BHIM from the Ramayana or the “Chota Bheem” from POGO TV or Cartoon Network. I’m telling you this because I saw many peoples being confused and assuming that it is named after the BHIM from the Ramayana (It’s funny, but yet true).

The name BHIM stands for Bharat Interface for Money. It is developed by the National Payment Corporation of India (NPCI). According to the makers of BHIM, …

“Bharat Interface for Money (BHIM) is an initiative to enable fast, secure, reliable cashless payments through your mobile phone. BHIM is inter-operable with the other Unified Payment Interface (UPI) applications and bank accounts. BHIM is made in India and dedicated to the service of the nation.”

How it works?

Register your Bank Accounts with the BHIM app and set an UPI PIN for the Bank Account. Your mobile number becomes your Payment Address (PA) and simply you can start your transactions. Yes! It is simple as that.

- You may also read: How to Register in any UPI enabled applications?

Features of the BHIM App:

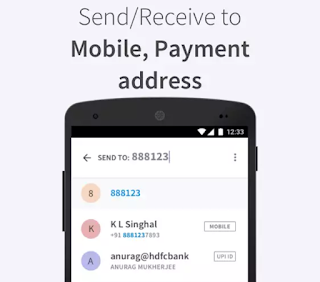

Send and Receive Money:Send and Receive Money to your friends, family, customer or anyone through a mobile number or payment address. The money can also be sent to any Non-UPI Supported Banks using IFSC and MMID. You can also collect money by sending money request and also you can reverse such transactions. Now you may also want to know, How to Perform a transaction in UPI enabled applications? or continue reading this post.

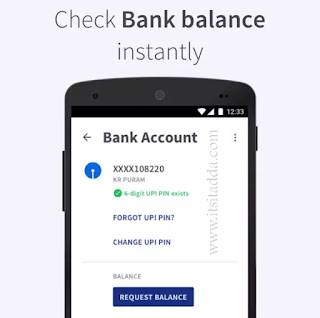

Check Balance:

You can check your balance and transactions on the go in just one click.

Custom Payment Address:

There can be some situations when you don’t want to share your mobile number with others to send or receive money. Don’t worry, BHIM have got your back. There’s no need to share your mobile number if you don’t want to. You can have a Custom Payment Address to send or receive money.

QR Code:

You can scan and use QR Code to simplify things and get rid of entering payment address while doing any transactions. Merchants can use their QR Code to collect money from the customers by displaying it or it’s printout.

Transaction Limits:

There are some limits to BHIM as well to do transaction as same as other payment apps. You can use up to ₹10,000 per transaction with a limit of ₹20,000 within 24 hrs.

Language Supported:

At present (Jan, 2017) it only supports Hindi and English. But they working to bring it with many languages of India in the future.

You can contact the developer with the email: [email protected]

List of Supported Banks (as of Jan, 2017):

- Allahabad Bank

- Andhra Bank

- Axis Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Catholic Syrian Bank

- Central Bank of India

- DCB Bank

- Dena Bank

- Federal Bank

- HDFC Bank

- ICICI Bank

- IDBI Bank

- IDFC Bank

- Indian Bank

- Indian Overseas Bank

- IndusInd Bank

- Karnataka Bank

- Karur Vysya Bank

- Kotak Mahindra Bank

- Oriental Bank of Commerce

- Punjab National Bank

- RBL Bank

- South Indian Bank

- Standard Chartered Bank

- State Bank of India

- Syndicate Bank

- TJSB

- UCO Bank

- Union Bank of India

- United Bank of India

- Vijaya Bank

- Yes Bank Ltd.

Let us know what you think of this app? in the comment box below and do like, comment and share it others. Thank you for reading this, Have a good day!